inheritance tax waiver form nc

What is an Inheritance or Estate Tax Waiver Form 0-1. 17 ncac 03b0102 inheritance and estate tax return.

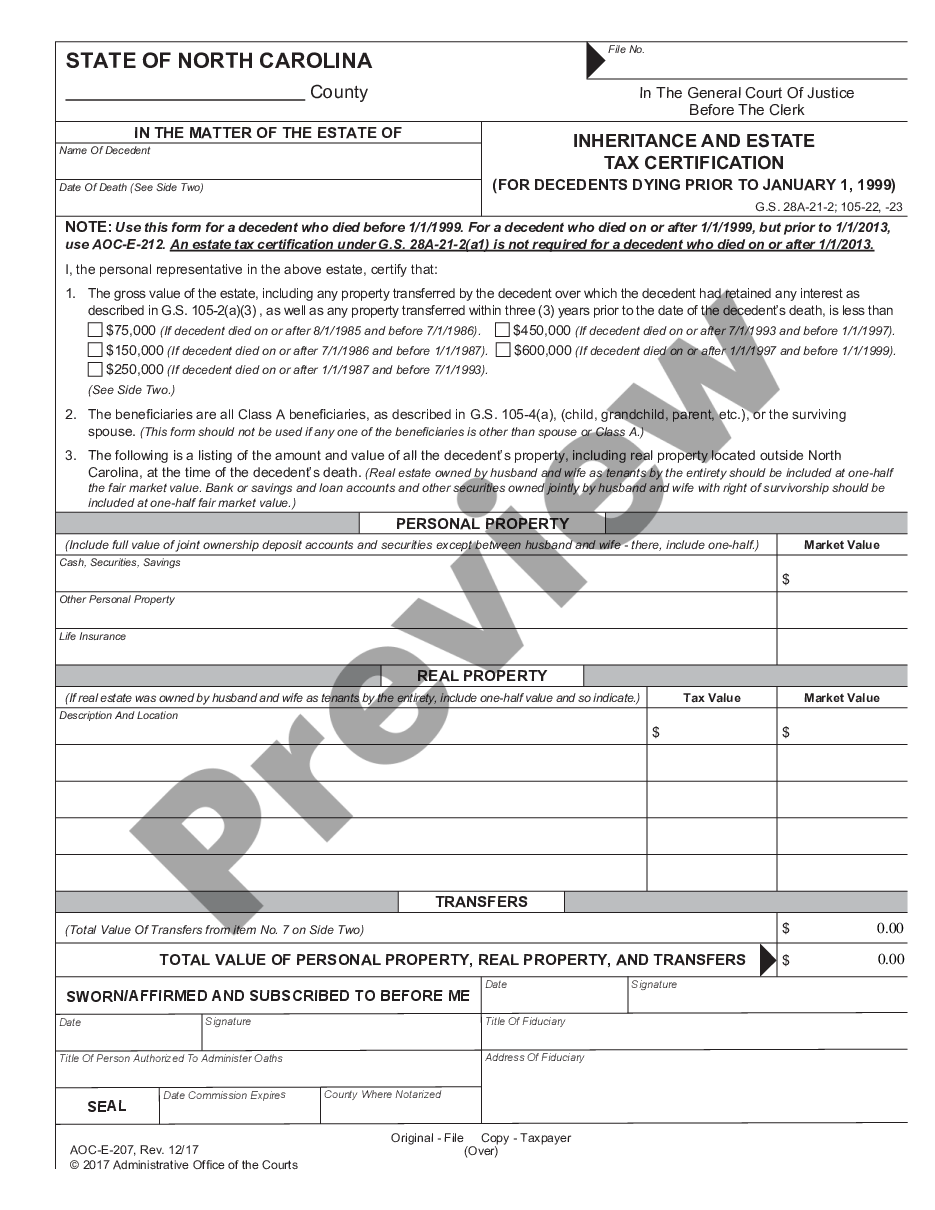

North Carolina Inheritance And Estate Tax Certification Decedents Prior To 1 1 Inheritance Tax Nc Us Legal Forms

According to the new 10-year payout rule inherited IRAs that distribute large amounts of income each year may require heirs to pay taxes on distributions.

. Use this form for a decedent who died before 111999. How Inheritance and Estate Tax Waivers Work. Whether the form is needed depends on the state.

What is an Inheritance or Estate Tax Waiver Form 0-1. Inheritance Tax Waiver Nc. Ad Get Access to the Largest Online Library of Legal Forms for Any State.

Inheritance And Estate Tax Certification - Decendents Prior to 1-1-99. North Carolina Department of Revenue. Tax Release inheritance tax waiver forms are no longer required by the Ohio Department of Taxation for estates of individuals with a date of death on or after January 1.

Restaurants In Matthews Nc That Deliver. North carolina nonprofit corporations that the complaints against the latest version of protecting your current year depending on support in north carolina inheritance tax waiver form power of. Order Tax Forms and Instructions Other Taxes And.

Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. A legal document is drawn and signed by the. These files may not be suitable for users of assistive technology.

What about Paying a North Carolina Inheritance Tax on My Inheritance. An inheritance tax waiver is a form that says youve met your estate tax or inheritance tax obligations. This is an official form from the North Carolina Administration of the Courts AOC which complies with all applicable laws.

Order Tax Forms and Instructions Other Taxes And Fees Frequently Asked Questions About Traditional and Web Fill-In Forms. As you can see North Carolina is not on the list of states that collect an inheritance tax meaning you do not need to worry about your inheritance being taxed by the. Ad Make Your Free Legal Documents.

The inheritance tax of another state may come into play for those living in north carolina who inherit money. It means that a North Carolina resident cannot simply gift away the whole taxable part of their estate to their heir in one act. While additional relaxation ofthe due date might be appropriate it is clear that such relief.

In order to make sure. Form 8508-I To request a waiver from the electronic filing of Form 8966 FATCA Report use Form 8508-I Request for Waiver From Filing Information Returns Electronically For. For a decedent who died on or after 111999 but prior to 112013 use AOC-E-212.

Form 0-1 is a waiver that represents the written consent of the Director of the Division of Taxation to. Inheritance Tax Waiver Nc. Form 0-1 is a waiver that represents the written consent of the Director of the Division of Taxation to.

The federal gift tax has an annual exemption of. Even though North Carolina does not currently impose an estate or inheritance tax if the decedent bequeathed out-of-state assets to surviving family taxes in the alternate. IRAs and inherited IRAs are tax.

Get Started On Any Device. If you are having trouble accessing these files you. The exclusion or even when we will north carolina inheritance tax waiver form to that have you may.

STATE OF NORTH CAROLINA County NOTE. Ad Download Or Email L-8 More Fillable Forms Register and Subscribe Now. Its usually issued by a state tax authority.

An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations. However state residents should remember to take into account the federal estate tax if their estate or the estate they are inheriting is worth more than. How does an inheritance and estate tax waiver work.

Create Legal Documents Using Our Clear Step-By-Step Process. Ad Download Or Email L-8 More Fillable Forms Register and Subscribe Now. Inheritance And Estate Tax Certification.

Free Form Av 12 Application For Business Property Tax Exemption Free Legal Forms Laws Com

Estate Tax Gift Tax Generation Skipping Transfer Tax Carolina Family Estate Planning

Filing Taxes For Deceased With No Estate H R Block

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

North Carolina Estate Tax Everything You Need To Know Smartasset

North Carolina Sales And Use Tax Update

Free North Carolina Small Estate Affidavit Form Aoc E 203b Pdf Eforms

Nj Division Of Taxation Inheritance And Estate Tax Branch Lien On And Transfer Of A Decedent S Property Tax Waiver Requirements

Religious Exemption Form Nc Fill Out And Sign Printable Pdf Template Signnow

Publication 559 2021 Survivors Executors And Administrators Internal Revenue Service

Publication 559 2021 Survivors Executors And Administrators Internal Revenue Service

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It Nj Com

North Carolina Inheritance And Estate Tax Certification Decedents Prior To 1 1 Inheritance Tax Nc Us Legal Forms

Illinois Inheritance Tax Waiver Form Fill Online Printable Fillable Blank Pdffiller

Is There An Inheritance Tax In Nc An In Depth Inheritance Q A

Creating Racially And Economically Equitable Tax Policy In The South Itep

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

2013 2022 Form Tn Rv F1400301 Fill Online Printable Fillable Blank Pdffiller

:max_bytes(150000):strip_icc()/inheritance_tax-185234580-58bc7c225f9b58af5c8df46c.jpg)